By George Boubouras & Melissa Platt

What is the appropriate asset allocation?

Your asset allocation is your core driver of investment performance through your life cycle. For an endowment fund (or Foundation/Charity/Not-For-Profit fund), it is the key contributor of performance through multiple economic cycles. It is no surprise that the appropriate asset allocation will differ for most investors, depending on the return expectations, risk tolerance (can you sleep at night?), investment time horizon and the stage of your life cycle (for an individual).

The basic building blocks of asset allocation

Your asset allocation over time will be the core driver of your total investment return. Most investors should be diversified across all asset classes, and within each asset class, to help lower the overall volatility of your portfolio returns. The goal of course is to have exposure to asset classes that are negatively correlated through a cycle. The 1991-92 recession, the Asian financial crisis (1997/98), the technology bubble pop of late 2000, the unforgiving GFC (2008), the subsequent European credit crunch (versions 1-3) and the most recent March 2020 pandemic induced severe global recession, are some clear examples where diversified portfolios significantly lower the volatility of your portfolio while aiming to preserve capital through the cycle.

The art of portfolio diversification is that it effectively reduces the risks and helps increase your wealth systematically over time.

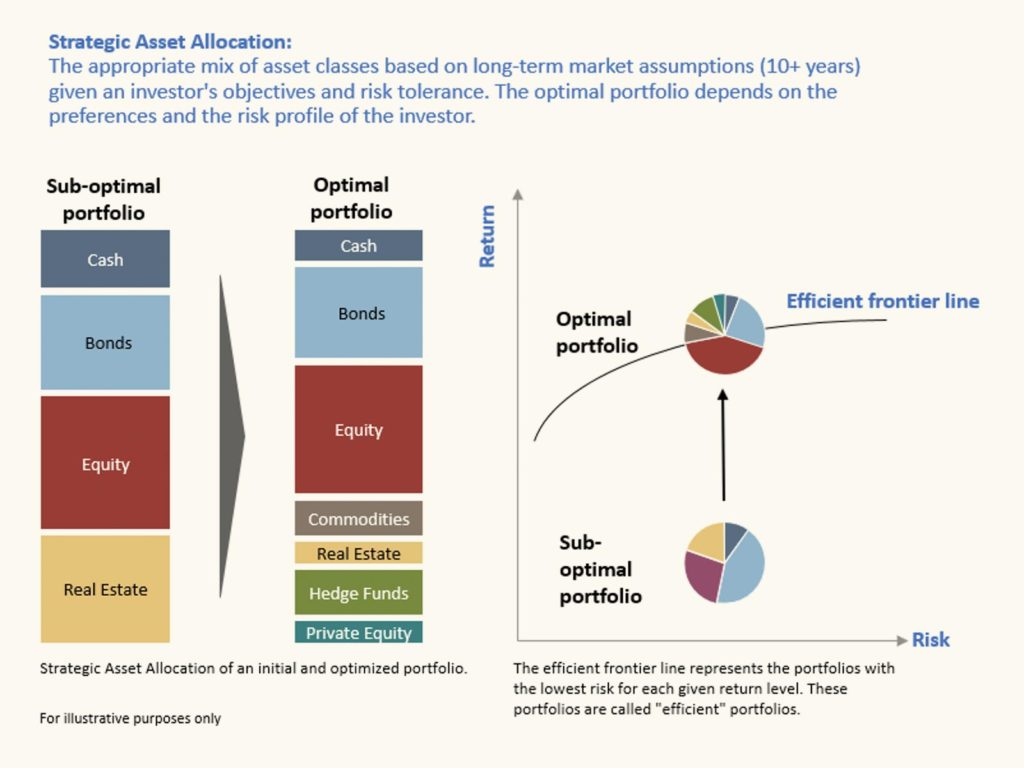

The starting point, in fact your building block for portfolio construction, is your Strategic Asset Allocation (SAA). The question from the outset is what is the appropriate weighting to the key asset classes? This will typically consist of the following: Cash, Fixed Interest (sovereign and credit), Equities (global and domestic), REITs (listed property securities) and Alternatives (i.e. private equity – PE, venture capital – VC, commodity themes and hedge funds – HF).

Your SAA weightings will reflect your “long term” return expectations, the level of volatility you can tolerate to be able to sleep at night and what stage of your life cycle you are at. Your SAA will also differ if you are a long-term Foundation, Endowment Fund, Family Office (FO) or a Not For Profit (NFP) that seeks to pay out a high proportion of income received annually or reinvest.

The SAA is the long run benchmark that aims to deliver the expected returns reflecting risk appetite over many economic cycles.

For example, when economies experience significant economic shocks such as the recent March global pandemic meltdown, there is the subsequent severe economic contraction. Volatility rises and asset prices collapse. This in turn results in a policy prescription response – both fiscal and monetary stimulus. There has been record levels of government stimulus within the G20 economies (over USD $9 trillion year-to-date) and over USD $10 trillion expansion of global central bank balance sheet. This has been a “whatever-it-takes” record level of stimulus to deal with the current global pandemic induced severe recession.

Going through some of the asset classes in more detail

Cash: Currently, the pandemic induced recession has resulted in the record levels of innovative central bank monetary stimulus that include low rates to effectively zero and some form of quantitative easing. The standard benchmark in the local market is typically cash or a Bank Bill Index. Over the past fiscal year (ending 30 June 2020), the New Zealand Bank Bill Index returned 0.93%. Expectations are for a zero to 0.25% range for year ahead in both New Zealand and Australia.

Currency is also an asset class that can provide further diversification. Currency exposure needs to be considered in the context of the entire SAA and within the asset classes. Within emerging markets, for example, often the investment case for a security includes the currency exposure in conjunction to the underlying business.

Fixed income is the traditional defensive asset class. It has the largest contribution to the Sharpe ratio for a balanced fund and is a large part of getting the portfolio on the efficient frontier (refer Figure 1). Despite the current low nominal yields of government bonds, they remain a defensive asset classes for future market shocks.

Domestic equities: The New Zealand equity market (NZSE) exhibits home bias and concentration risk like other equity markets. However, we believe it is one of the most expensive equity markets globally. The 1-year forward P/E multiple is approximately 30-32 times compared to other G20 economies that range between 15-22 times. There is has been an influx of index funds that are investing in the New Zealand equity market, in part due to the excessive quantitative easing underway globally. This has amplified the home bias as current equity prices in New Zealand appear elevated relative to broader New Zealand economic activity. A blend with the Australian equity market across the Tasman appears to be an appropriate blend.

Property, or real estate, is another asset class that adds diversification benefits and can be invested in directly or through a listed entity, domestically or globally. Investing in property is seen as a defensive exposure as it can hedge against inflation. Given that New Zealand and Australian investors typically have large relative exposure to residential and/or commercial property, this is taken into consideration when determining the most appropriate SAA for an investor.

International equities: Given the small size of the New Zealand and Australian equity market vs the global MSCI, there are some key sectors and exposures that investors will be missing out on. It is important to have exposure to global equities simply because of the diversification characteristics. We believe home bias is not optimal for your portfolio over time and that a global more diversified SAA leads to more attractive, less volatile, risk adjusted returns over the longer-term

Gold and commodities are other asset classes that can add to the diversification within a portfolio. Gold is the traditional real store of wealth that offers no yield. It acts as a hedge against inflation, elevated volatility and weakness in the USD. Exposure can be in many different forms, from direct bullion, gold stocks (leverage play via balance sheet exposure), ETFs and some specialised fund managers.

Commodities are broader and involve leveraged metal themes, rare earths (key in technology, healthcare and defence), energy (traditional and renewables) and soft commodities.

Alternative investments are another source of diversification. A combination of private equity exposure and dynamic hedge fund strategies aimed at enhancing risk adjusted returns could benefit the portfolio. For private equity and venture capital, these are typically longer-term investments and illiquid, and this factor needs to be explored as this will impact investors differently. Ultimately, investors require compensation by way of a higher rate of return due to the lack of liquidity, the long-term investment horizon and potentially unlisted characteristics typically exhibited by these investments.

Summary

In summary, your asset allocation must reflect your return expectations, the amount of risk you employ (volatility) to meet your investment objectives and your investment time frame (which reflects your stage of your life cycle).

In the current pandemic induced global recession, we believe the appropriate diversification across asset classes remains important. Currently, there is a record amount of fiscal and monetary stimulus globally to support the long recovery. There is a recovery underway and current asset prices reflect the prices in the future as the economy rebounds.

Of note, costs need to be considered for all investors, but there is an optimal portfolio allocation that will meet your return expectations and take into account the level of volatility that is appropriate for your needs over time.

Source/References

Bodie Z., Kane A., Marcus A., (1996), Investments, Irwin, U.S.A.

Arnott R., Fabozzi, F. (1988), Asset Allocation: A Handbook of Portfolio Policies, Strategies and Tactics, Probus Professional Publishers, U.S.A.

UBS WM: Quantitative Investment Solutions (QIS) application for portfolio analysis and simulation tool, User Guide Version 2.8, Dr Nav Sehmi, January 2008

UBS WM Australia: Education Note – Asset Allocation 101, George Boubouras, March 2012

International Centre for Financial Services (ICFS), The University of Adelaide, Asset Allocation 101 – Portfolio Theory, George Boubouras. September 2019

The material has been prepared for educational purposes only without regard to any persons investment objectives, financial situation, or means, and we are not soliciting any action based upon it. This material is not to be construed as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product, or instrument; or to participate in any particular trading strategy in any jurisdiction in which such an offer or solicitation, or trading strategy would be illegal. Please consult your independent financial adviser prior to taking any investment decision on the basis of any information contained herein and no information herein constitutes general or specific investment, legal, tax or accounting advice of any kind.