New Zealanders love to invest in property, everything from their own home, investment property, to the holiday bach. Property is an attractive investment given that its tangible (unlike investing in shares), can provide a good rental yield, there are no capital gains tax, no stamp duty and valuations have generally been increasing since 2010.

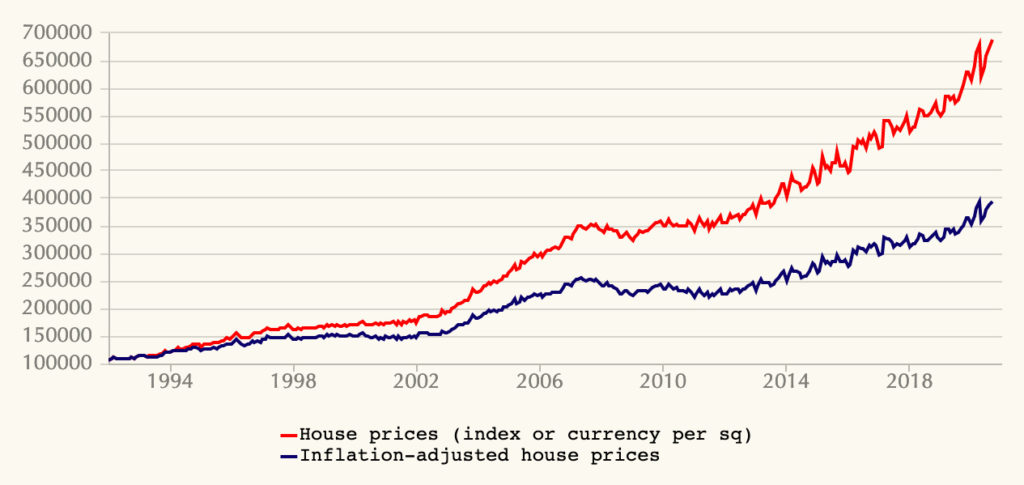

House Price Rises in New Zealand

Source: REINZ

There are some considerations when investing in property that need to be addressed. Property investment (separate from owning your own home) does have some explicit costs; owners are responsible for the maintenance, rental agreements and the tax implications of owning the property. Also, there is risk that the rental property is untenanted for a period of time and therefore not earning rental income to help pay the mortgage. They are also at the mercy of changes in regulations that can make it difficult to evict undesirable tenants. When cashflows are impeded, the negative impact of the leverage effect can spread from one property to an entire property portfolio.

Despite this, owning property and especially investment properties is extremely popular and growing; all helped by the low interest rate environment and the currently relaxed loan-to-value ratios (LVRs) for borrowing. This is fueling prices, particularly residential house prices across the country. What investors tend to forget is that property prices can also go down and that we will not be in this low interest rate environment forever.

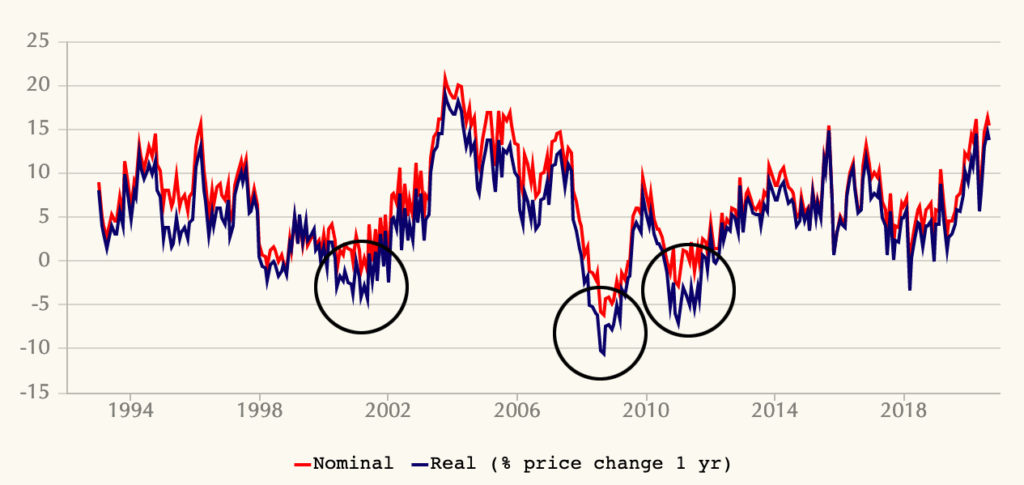

Monthly House Price Changes – all NZ

Source: REINZ

It’s worth noting that property prices been driven higher due to excess demand, but with less immigration, the reform in the Resource Management Act to ease supply restrictions, less demand for office buildings and office space in a more flexible post COVID world and the possibility of a form of capital gains tax – all point towards potentially slower growth in property prices in the future.

Another trigger for a correction could be affordability. Affordability both in terms of rent and mortgage servicing are not sustainable as debt-to-income levels are rising even though we are in environment when interest rates are at all-time lows. When interest rates rise this will, eventually, have knock-on effects to the prices of properties both residential and investment. A small increase in interest rates will have a significant negative impact on those running on high debt to income levels. According to recent RBNZ data, more than 40 per cent of first-time home buyers in June 2020 took on debt greater than five times their annual income. There was $1.09 billion lent to first home buyers in June, and about $146m loaned to households with debt more than six times their yearly income. Even more alarming is that the New Zealand house price to income ratio recently hit a record high at 7.7 times with Auckland at 10.1 times! To put this in perspective with the rest of the world, Ireland capped mortgages at 3.5 times income to reduce risks in its financial system after the global financial crisis. In 2014, the Bank of England put limits on mortgage lending above 4.5 times income to stifle debt and rising house prices.

But for those that have invested in New Zealand property and been successful, none of this is news and with property valuations continuing to rise and interest rates low for the foreseeable future – the question then becomes – why invest in anything else?

The answer is simple, risk. There are several factors to consider when thinking about the future of property returns. Firstly, notwithstanding the considerations raised above, having your money invested solely in property leaves you open to sector specific risk, that is, when there is a correction in the property market you have no mitigating factors to offset the falling market. We last saw this happen in 2011, then in 2008 post the global financial crisis and prior to that in 2000 after the dot.com crash.

Property investment can be illiquid. On the surface, direct property investment may seem less volatile than other market investment returns but direct property is not valued daily, weekly or even monthly. At the end of the day, just because the volatility in value is not recorded doesn’t mean it doesn’t exist and a property is only worth what someone is willing to pay for it when you come to sell it. Without a liquid trading platform some property investments may be illiquid and expensive to transact. Illiquidity can become a significant problem in distressed debt selling situations, as we have observed in circumstances where people are nearing retirement or need emergency funds.

To mitigate these risks, portfolio diversification across asset classes is key i.e. ‘don’t put all your eggs in one basket’. Global diversification across asset classes, markets, sectors and currencies provide returns relative to your appetite for risk and benefits that help preserve and grow capital over the medium to long term. Additionally, diversification does not need to be just in ‘traditional’ portfolios but can also include investments in ‘real assets’, like natural resources (e.g. water) and commodities (e.g. farming and horticulture) etc. Real assets are appropriate for inclusion in most diversified portfolios because of their relatively low correlation with financial assets, such as stocks and bonds.

In summary, diversification is the key to protecting capital in the long term with less volatility in returns that allows you to sleep at night. To achieve this, you should seek the advice of an independent, qualified, financial adviser who will recommend an appropriate investment strategy, taking into consideration your whole balance sheet, risk profile, investment objectives and time horizon.

Data sources: interest.co.nz, globalpropertyguide.com, reinz.co.nz.

Important Notice

This material has been prepared for informational purposes only without regard to any persons investment objectives, financial situation or means, and we are not soliciting any action based upon it. Please consult your independent financial adviser prior to taking any investment decision on the basis of any information contained herein and no information herein constitutes general or specific investment, legal, tax or accounting advice of any kind. We are not liable for any loss (whether direct, indirect or consequential) that may arise or result from any use of the information contained herein or derived herefrom.

No reproduction of any material either in part or in full is permitted without our prior written permission.